Is Cash Trash?

Famed bond investor Ray Dalio recently said, “Cash is trash!” He warned that the growing U.S. dollar money supply will lead to its devaluation. In the interview, Dalio advocated having a diversified portfolio, including gold.

In somewhat of a contrast, Warren Buffet recently sold large portions of Berkshire Hathaway investments so it can have a large cash hoard. Buffet is anticipating more economic weakness and preparing to purchase stocks on the cheap.

Another investor, Brent Johnson of Santiago Capital, has popularized his “Milkshake Theory” of money. In a nutshell, Johnson believes that the world economic system is set up in a way that continually reinforces U.S. dollar strength. Under the Milkshake Theory, U.S. cash is king and will stay that way for longer than most investors believe.

If you’re not a professional investor, then why should you care about any of this? It matters for those of us in the U.S. because we earn U.S. dollars and own assets priced in U.S. dollars. If the dollar falls, so does the value of your cash savings and your dollar assets (stocks, bonds, houses, etc.). Most in the U.S. have all their wealth in dollars and dollar assets, which I believe is a risky proposition.

Is Cash a Good Store of Wealth?

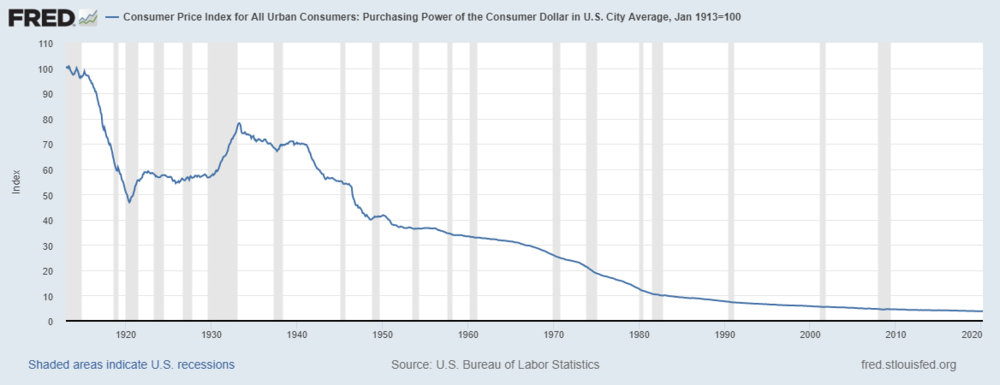

It is common knowledge that holding a significant percentage of your wealth in cash isn’t wise, because it gets eaten away by inflation. As you can see from the chart below, the purchasing power of the dollar has been severely eroded since its creation in 1913. Worse yet, many commentators believe federal statisticians have understated the dollar’s decay, because of dubious changes in how inflation is calculated.

In the last century, you could deposit money in a savings account or buy a certificate of deposit (CD) and get a reasonable rate of return, enabling you keep up with inflation. In today’s ultra-low interest rate environment, you can’t get a decent return unless you buy risky stocks or bonds. Even real estate can be a risky investment, as the 2008 great recession taught us.

For the average person, cash is trash. We are forced into risky investments to preserve our wealth. But if we don’t take those risks, we are guaranteed a loss. It’s like bucket of water with a leak in it. The problem with risky investments is that no one knows what the right investments are or how any particular investment will perform. So, wise people always diversify their wealth to shield against ever-present uncertainty.

Is Gold a Good Long-Term Investment?

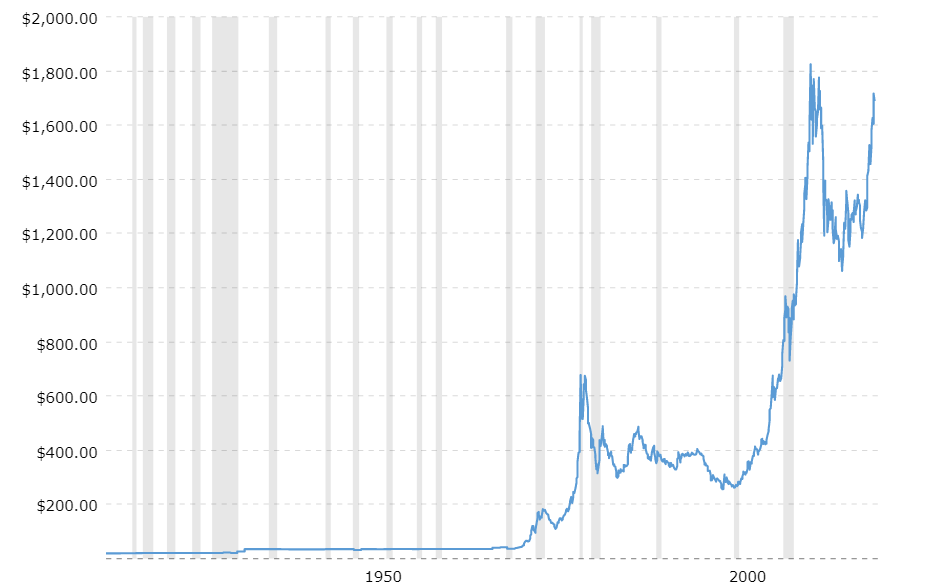

Most people don’t consider investing in precious metals, because they don’t understand them. See the chart of gold in U.S. dollars below. Look closely and you’ll see that this chart is roughly the inverse of the previous chart, showing how gold is an inflation hedge. Please note that the period up to 1971 is very flat because the U.S. was on a gold standard.

Keep in mind that gold’s shorter-term price movements are unpredictable and volatile. If you’d have bought gold in the 80s, you’d have been very disappointed. If you bought in 2000, you made out like a bandit.

Gold does not necessarily preserve wealth in the short or medium run. A reasonable solution to this problem is to buy incrementally over time to preserve your long-term purchasing power. I don’t view gold and other precious metals so much as an investment, but rather a long-term inflation hedge and store of wealth. It’s the bedrock of a well-diversified portfolio.

How Much Cash Should You Hold?

Even though it constantly devalues, you need cash on hand to pay bills and make purchases. Knowing how much cash to hold can be tricky, because you want just enough and no more. So, each person/family needs to determine the amount based on their specific situation.

Some people don’t hold enough cash and would be forced to borrow or sell retirement funds to handle an emergency. Some people have too much in cash (e.g. savings accounts, CDs, treasury bonds) and are getting hurt by inflation. Understanding the basics of inflation and your personal finances will help you make a good decision.

A Spiritual Take on the Issue

Do not wear yourself out to get rich;

do not trust your own cleverness.

Cast but a glance at riches, and they are gone,

for they will surely sprout wings

and fly off to the sky like an eagle. (Proverbs 23:4-5)

Specific interpretations might differ, but most would agree this proverb is advocating moderation and a healthy perspective on the uncertainty of wealth. You could view this in the Christian context as a warning to trust God instead of money or your own efforts. We may be clever and hard-working, but our plans don’t always work out and sometimes financial loss is unavoidable.

Some might see making the effort to diversify as “wearing yourself out to get rich” or “trusting in your own cleverness.” I see it as exactly the opposite. When you don’t make the effort to diversify, you’re placing a risky bet with your hard-earned wealth. In diversifying, you can sometimes miss out on certain investment gains, but over time it protects your wealth to use for the things that matter most in life.