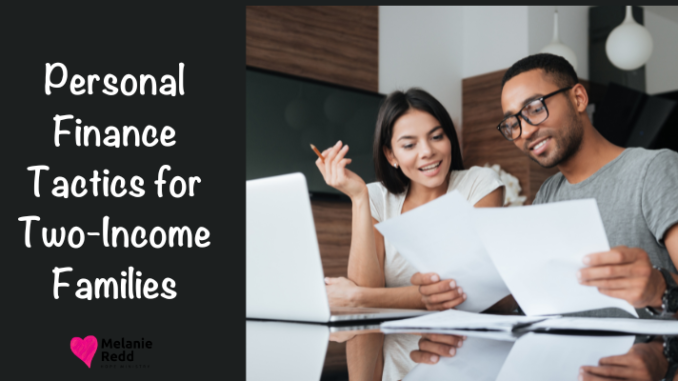

Personal Finance Tactics for Two-Income Families

Personal Finance Tactics for Two-Income Families

Do you find it tough to get through the current financial downturn?

Could you use a little help even though you and your spouse qualify as a two-income family?

Don’t feel alone.

Many hard-working parents and couples without children are discovering that a high inflation rate can quickly stress out a monthly budget.

What is the answer? For many couples, the solution includes several small changes that together can deliver a very powerful dose of fiscal relief.

The simple act of paying for a vacation with a personal loan can help people save a lot by taking advantage of early-bird and full-payment discounts on cruises, tours, and long-distance airline flights.

Other effective strategies include keeping credit card balances below 10% of the allowed credit limit, purchasing groceries monthly instead of weekly, saying goodbye to fast food, eliminating soft drinks, and maximizing tax-deferred retirement contributions.

Experiment with one or more of the following tactics to see which ones bring the most relief to your personal financial situation.

First, one personal finance tactic for two-income families is to pay for vacations with personal loans.

If you take annual vacations or do all-out major trips every few years, taking out a personal loan to pay for some or all of a big trip’s expenses can be a great way to save a bundle. The reason it’s wise to borrow is twofold.

First, by repaying loans on time, it’s possible to boost credit scores, which is a good thing.

Second, for major journeys, paying for most expenses up front gives you access to early-bird discounts on things like hotels, airfare, tour fees, and train connections.

Plus, travelers get peace of mind by knowing that the next vacation is fully paid for and all that’s left to do is have fun.

Second, another personal finance tactic for two-income families is to minimize credit card balances.

Two-income couples, with or without children, should do everything in their power to keep credit card balances low and manageable.

Again, this is a situation in which you get two rewards for doing one thing.

When you maintain balances at or below the 15% mark, meaning 15% of the total line, you help solidify scores with all three agencies. Using low amounts of available credit looks good on your reports.

Plus, low balances mean less interest and more money in your pocket.

Third, another personal finance tactic for two-income families is to buy groceries only once per month.

It’s almost like a small magic trick in that those who purchase groceries monthly instead of weekly tend to save about 10% on annual food purchases.

How does it work?

Those who limit grocery shopping to one time per month tend to be more careful about what they buy, use lists to select items, and use coupons for many purchases.

Weekly shoppers are more apt to engage in impulse buying, shop without detailed lists, and not use coupons.

Fourth, a final personal finance tactic for two-income families is to eliminate fast food and soft drinks.

One of the many different ways to strengthen relationships is to team up and work towards similar goals.

Want to give your budget a quick shot in the arm?

Cut soft drinks and fast food out of your life.

It can take a few months to get used to this new way of living, but the payoff can be much larger than you’d think. Some families can save more than $250 per month just by eliminating that two non-essential food and drink categories.

Were you encouraged by what you read?

Then, would you share this article with a friend, co-worker, or family member?

Or, maybe you can send it to a friend or family member?

This blog occasionally uses affiliate links and may contain affiliate links. Additionally, Melanie Redd is a participant in the Amazon Services LLC Associates Program. This is an affiliate advertising program designed to provide a means for sites to earn advertising fees. These are earned by advertising and linking to amazon.com. Also, for more on my disclosure policy, click HERE.

© Melanie Redd and Hope Ministry, 2022. Unauthorized use and/or duplication of this material without express and written permission from this blog’s author and/or owner is strictly prohibited. Further, excerpts and links may be used, provided that full and clear credit is given to Melanie Redd and Hope Ministry, LLC. Please give appropriate and specific directions to the original content.